AI-powered

trade

Automate compliance.

Maximise efficiency.

Unlock cross-border tax with cutting-edge technology.

From automated cross-border path determination to secure data management, our technology ensures your operations stay compliant, efficient, and ready for global expansion.

Optimised tax, compliance & payments

all in one place

Optimized taxation paths via the Xendo decision engine

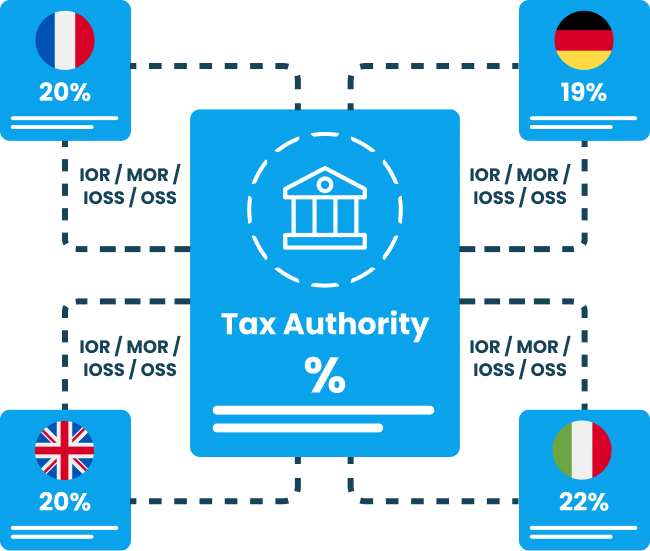

Xendo’s IOSS & decision engine simplifies DDU and DDP, making CIF, VAT treatment, duty payments, and settlements seamless.

Cashflow enhanced deposit forecasting

Xendo monitors VAT spend in real time, providing forecasting and trend analysis to optimise cash flow management.

Next-Gen

Tax Engine

Say goodbye to slow tax processing. Our high-speed tax engine process IOSS transactions in milliseconds.

Real-Time Regulatory Updates

Xendo keeps you aligned with the latest VAT, customs, and trade regulations, reducing risk and eliminating manual work.

Secure Data

Management

Xendo ensures data safety with ISO 27001-compliant policies, enterprise-grade encryption, and monitoring for seamless, compliant operations.

Payment Gateway

Integrations

Xendo integrates with leading acquirers and processors to facilitate checkout services for DDP merchants and DDU importers.

Trusted by

industry leaders

cross-border transactions

successfully processed.

Trusted by businesses around the globe.

99% customer satisfaction

We’d love to

hear from you

"*" indicates required fields