Fast-Track

cross-border tax and grow your business effortlessly.

📦 No IOSS registrations needed – Automated VAT & tax compliance.

💳 Payment Gateway Integrations with leading acquirers and processors.

📈 Monitor VAT spend & forecast to optimise cash flow.

Cross-border tax

made easy

E-commerce merchants

One-click Shopify integration

Reduce cost and no VAT admin

Boost cash flow with Xendo IOSS VAT refunds.

Optimise operations with real-time cross-border tax

Flexible terms & multi-currency

support

Last Mile Delivery

Go live in under 72 hours with expert support.

Effortless IOSS VAT management without disrupting sales.

Integrated IOR and MOR services.

AI-powered duty and VAT classification and decision engine

Carriers

Concierge onboarding.

24/7 post checkout support for uninterrupted sales.

Automated duty & tax with Xendo VAT refunds on returns.

Integrated real-time customs and compliance reporting.

DDU calculator with automated

payments.

Automate eCommerce VAT refunds on cross-border returns to boost

cash flow

Effortlessly reclaim VAT on eCommerce returns with Xendo IOSS. Automate refunds, reduce costs, and accelerate cash flow—no manual processing, no delays. Use our VAT Refund ROI Calculator to see how much you can save today!

VAT Refund ROI Calculator

Trusted by

industry leaders

cross-border transactions

successfully processed.

Trusted by businesses around the globe.

99% customer satisfaction

Optimised tax, compliance & payments

all in one place

Optimized taxation paths via the Xendo decision engine

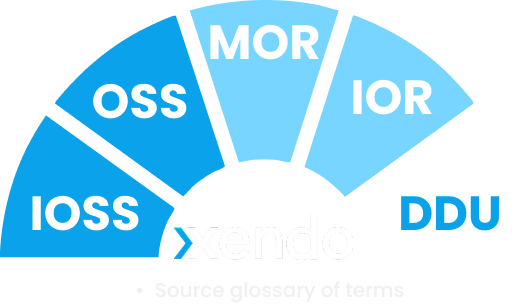

Xendo’s IOSS & decision engine simplifies DDU and DDP, making CIF, VAT treatment, duty payments, and settlements seamless.

Cashflow enhanced deposit forecasting

Xendo monitors VAT spend in real time, providing forecasting and trend analysis to optimise cash flow management.

Next-Gen

Tax Engine

Say goodbye to slow tax processing. Our high-speed tax engine process IOSS transactions in milliseconds.

Real-Time Regulatory Updates

Xendo keeps you aligned with the latest VAT, customs, and trade regulations, reducing risk and eliminating manual work.

Secure Data

Management

Xendo ensures data safety with ISO 27001-compliant policies, enterprise-grade encryption, and monitoring for seamless, compliant operations.

Payment Gateway

Integrations

Xendo integrates with leading acquirers and processors to facilitate checkout services for DDP merchants and DDU importers.

Xendo trade insights

successes & compliance

AX Paris cuts IOSS costs & grows EU sales with Xendo

Xendo’s guide to IOSS, DDP, IOR & More

We’d love to

hear from you

"*" indicates required fields